Investors should not ignore cryptocurrencies’ threat to incumbent payment services like Visa, Mastercard, and PayPal, . In a note to clients, the MoffetNathanson analyst said that emerging use-cases could pose an existential crisis in the future.

As Ludicrous As It May Sound

“Why would I ever buy coffee with bitcoin?” asked Ellis, before ensuring her clients that it is a distinct future possibility, “as ludicrous as it may sound.”

Though it may sound “ludicrous” to Ellis’ investors, the concept is fairly standard in cryptocurrency circles. In fact, work is well underway to make it happen — despite Ellis’ assurance that it is unlikely to occur soon.

As Bitcoinist , noted bitcoin bull Tim Draper thinks everybody will be doing it in just two years time. Except him, of course, as he doesn’t intend to spend or sell any.

Furthermore, Starbucks received ‘significant’ equity in bitcoin futures platform, Bakkt, to accept in-store bitcoin payments this year.

Improvement On Fiat

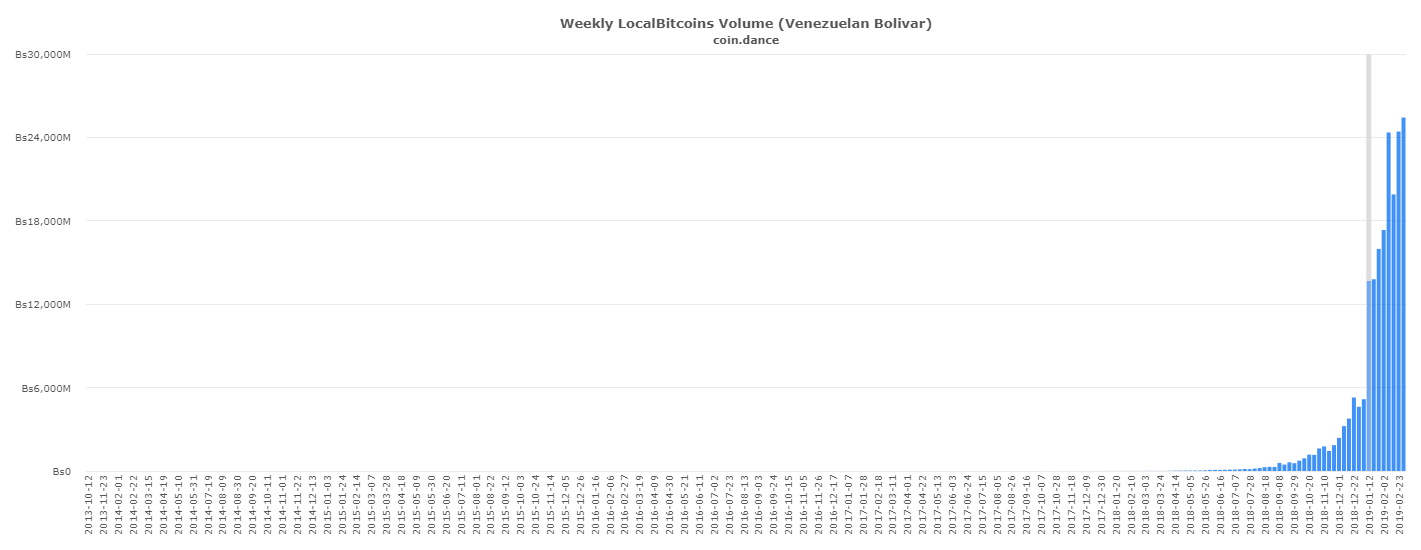

The growth of bitcoin use in is another factor of concern for the incumbents, according to Ellis:

(Cryptocurrency systems) core design characteristics — which are aimed at enabling ‘freedom of money’ — are in direct contrast to the characteristics of most traditional, private payment systems.

She suggests that the networks also need to embrace blockchain technologies or cede further ground in the cross-border payments market.

A combination of emerging use-cases, relative price-stability, and improvements such as Lightning Network implementation, are once more pushing bitcoin’s .

Arrogance Comes Before A Bigger Fall

One of the greatest threats to private payment systems could be their own arrogance. Perhaps secure in their belief that there is no viable alternative to their services, they continue to . Retailers, however, can only be pushed so far and there are signs of against high fees — particularly with Visa. The successful implementation of bitcoin payment solutions could easily upend the hegemony of Visa and Mastercard.

Ellis’ advice to clients on all three companies (Visa, Mastercard, and Paypal) is to buy, but for how much longer is another question completely.

What do you think about Ellis’ advice? Let us know your thoughts in the comments below!

Images courtesy of Shutterstock, Coin.Dance.

The post appeared first on .

is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

source:

TheBitcoinNews.com is here for you 24/7 to keep you informed on everything crypto. Like what we do? Tip us some Satoshi with the exciting new Lightning Network Tippin.me tool!

Published at Wed, 06 Mar 2019 00:00:02 +0000