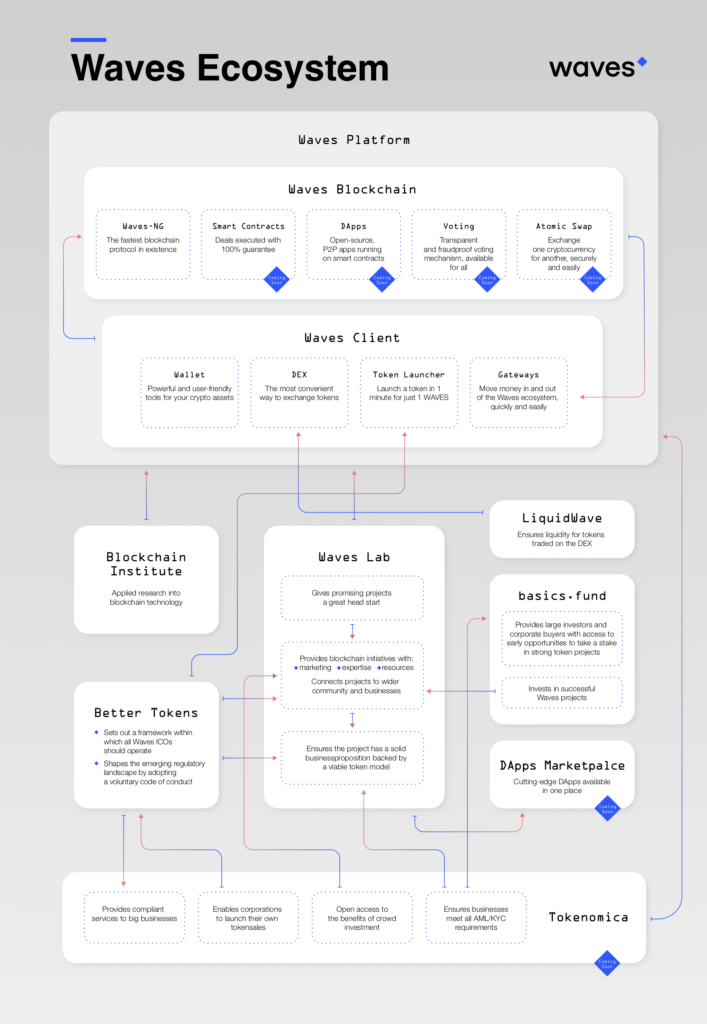

You probably know that the Waves ecosystem provides solutions for safely and securely storing, trading, managing and issuing your digital assets – but we’re willing to bet that there’s plenty about Waves you don’t know.

The Fastest Blockchain in the World

Did you know that Waves is capable of handling hundreds of transactions per second?

The Waves network has implemented a ground-breaking new protocol which will allow its blockchain to process — meaning Waves is the fastest blockchain in the world and plans to stay that way.

On top of that, Waves-NG – a next-generation consensus algorithm based on Cornell Computer Science academics Emin Gün Sirer’s and Ittay Eyal’s bitcoin-NG proposal – is making the platform even easier and faster than ever before.

Waves-NG is the first blockchain to adapt the bitcoin-NG proposal, which was to address bitcoin’s scalability issues by turning it into a proof-of-stake consensus.

A Safe, Secure, and Multifunctional Wallet

Did you realize that, when utilizing Waves’ wallet, your funds are stored in a blockchain address that only you control? That means that you — and only you — can access your crypto assets.

In addition to taking advantage of Waves’ outstanding security, you can create a multiple-currency wallet, receive interest on your Waves account balance, transfer funds from person to person, and mine cryptocurrency easier than ever.

A Decentralized Exchange

Unlike other inferior centralized exchanges, there are no limits on withdrawals when using Waves’ decentralized exchange — and every cryptocurrency purchased immediately appears in your wallet’s balance.

Waves also features a matcher and high channel capacity, which allows traders to make deals as quickly as on a centralized exchange — but without the risk of losing your money.

Waves exchange also features unprecedented security, as funds are kept in your wallet — not on the exchange!

Fees are also kept to a minimum, with only a small fixed commission on a per-order basis.

You Can Issue Your Own Tokens

Did you know that you can get your own internal digital currency by using Waves? You can also use the blockchain for crowdfunding, or paying for goods and services, and tokens can be utilized to create voting systems and loyalty/rewards programs.

So far, a total of 11,489 tokens have been released on Waves, with a total market capitalization of more than $1 billion.

Waves Covers Everybody

Waves isn’t just good for developers, who can enjoy the benefits of high network throughput capacity, low latency and low transaction fees. It’s also great for organizations, as it allows them to issue their own blockchain tokens and give your businesses a head start with crowdfunding, loyalty programs, voting and more.

Of course, Waves is also good for traders, who can store assets securely in the local lite client, whilst also trading them quickly and safely on the built-in decentralized exchange (DEX).

On top of all that, Waves is partnered with Deloitte — which will help them launch the development of a legal framework for the wider adoption of blockchain technologies.

If you want to see what Waves can do for you, check out of the extensive here:

What do you think about the Waves blockchain platform? Share your thoughts below!

Images courtesy of Waves, Shutterstock

Published at Thu, 08 Mar 2018 20:00:32 +0000

Altcoin reviews