By : The surged as much as 7.60-percent on Friday to establish a new 2019 peak at $5,796.93. The uptrend pushed ’s year-to-date rally to an impressive 54.08-percent. At the same time, it brought the asset’s total recovery to an astounding 82-percent and set the well on its way to a fresh record high.

Here are three factors that indicate the price has not only found a bottom but is also well on its way to smashing through the $20,000 peak it set in late 2017.

Reason 1: Moving Averages Mimic Historical Pattern from 2015

Yesterday, Factor author Peter Brandt the price could hit $19,800 in the future.

He backed his prediction using a weekly moving average indicator, noting that it was now trending below the spot price.

The last time such a move took place was in November 2015 and preceded ’s triumphant march from $340 in 2015 to a whopping $19,800 in 2017.

The last time Factor’s benchmark weekly MA was in the current profile of turning from down to up was in Nov 2015 just as began its move from $340 to $19,800.

— Peter Brandt (@PeterLBrandt)

Robert Sluymer, a technical strategist at Wall Street strategy firm , also believes that is pounding into a bull market.

The financial expert said the asset could initially go through a pullback towards its 200-weekly moving average following its most recent push toward $6,000.

But after that, it could enter a mammoth accumulation phase which, as by Fundstrat co-founder Thomas Lee, could push the price toward $20,000.

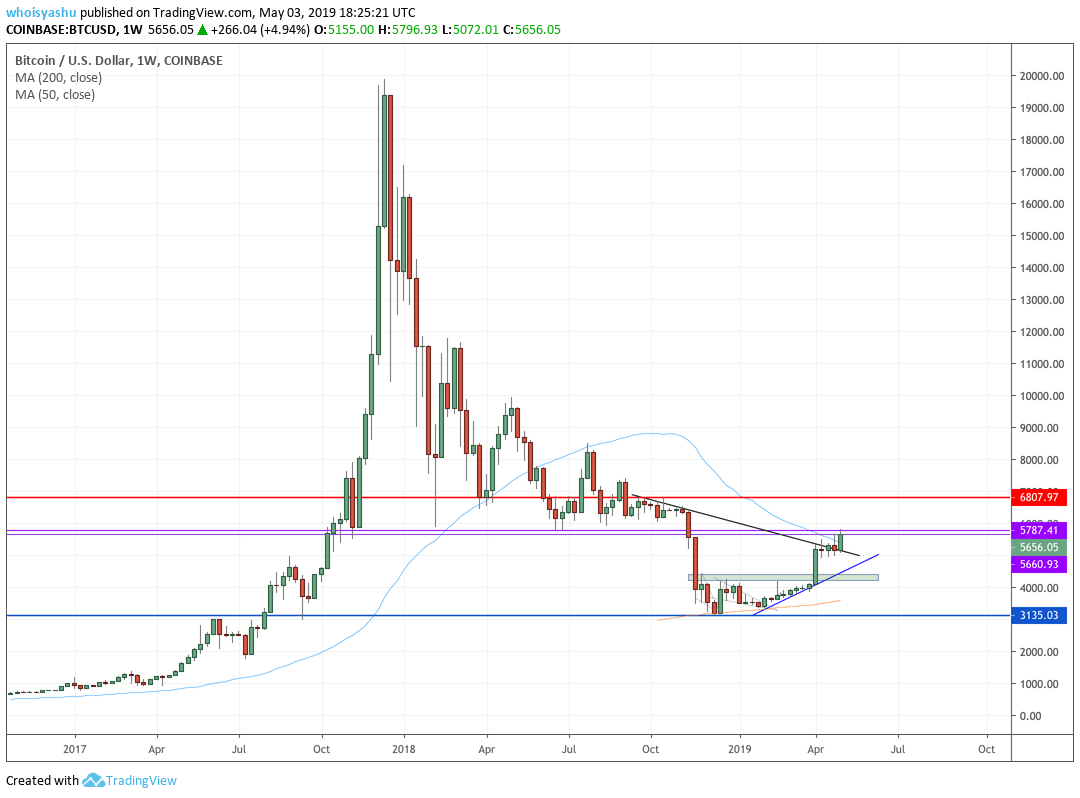

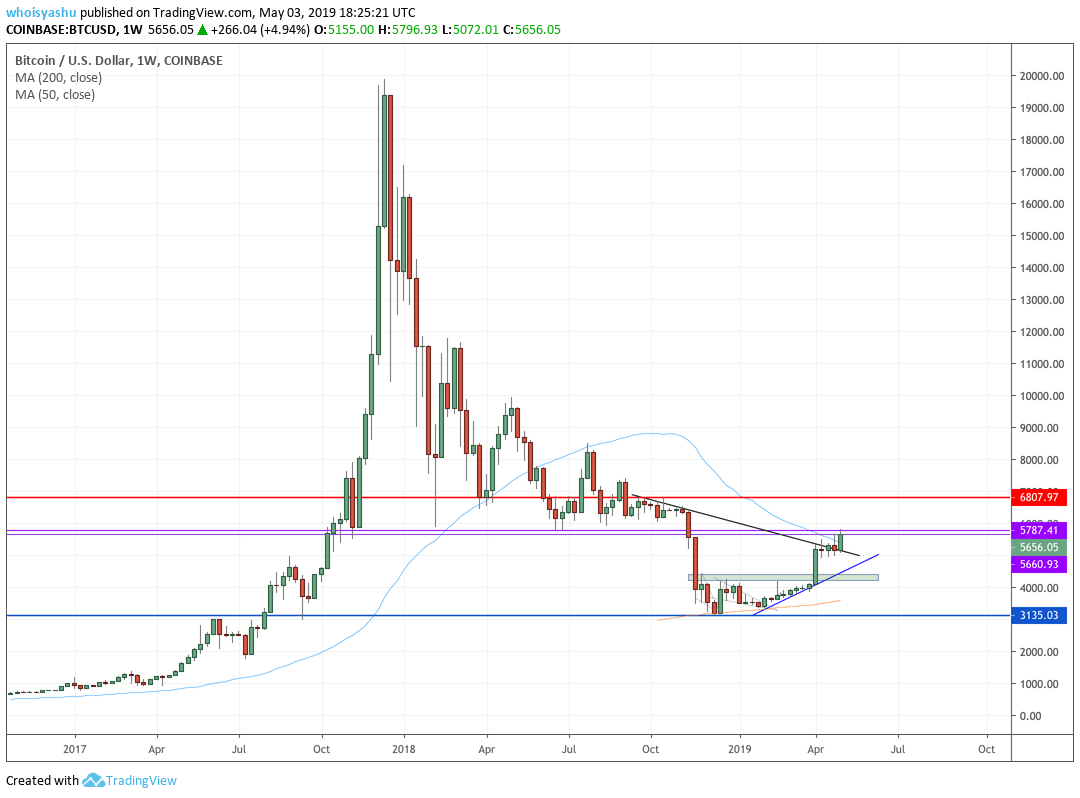

PRICE NOW ABOVE 50-WEEKLY MOVING AVERAGE | SOURCE: TRADINGVIEW.COM,

The latest jump also closed the price above its 50-weekly moving average, as shown via the blue curve in the chart above.

The 50-WMA historically signaled a strong bullish bias whenever the price was trending above it. crashed below the 50-WMA in May 2018 during a wild downside market action, after which the price careened as low as $3,100.

With now above the 50-weekly MA, the probability of bull run is high.

Reason 2: Relative Strength Index Rages Bullish

’S WEEKLY RSI IN BULL ZONE | SOURCE: TRADINGVIEW.COM,

Recently, ’s weekly Relative Strength Indicator jumped above 53.65, its highest level since October 2015.

The level, as indicated via a red horizontal line in the chart above, so far served as a yardstick to measure a bull or a bear trend.

When it jumped above 53.65, the buying sentiment in the market improved. And when the RSI went below that mark, as it did during the January 2018, it triggered sell pressure.

Reason 3: The bitcoin Price Formed a ‘Golden Cross’

FORMED GOLDEN CROSS, AND AN UPSIDE RALLY ENSUED | SOURCE: TRADINGVIEW.COM,

A is achieved when an asset’s short-term moving average jumps above its long-term moving average.

The price witnessed one of these formations back in October 2015 when it was near $300. Later, the asset underwent one of its longest bullish periods, which eventually brought the price close to $20,000. It once again formed a Golden Cross in April 2019, signaling a potential long-term upside scenario.

All three of these factors bolster the argument that the price will retest the $20,000 mark, perhaps even sooner than many bulls expect. For now, is at $5,700.

Published at Fri, 03 May 2019 21:13:39 +0000