We’re joined by Monica Quaintance, Head of Engineering and Adoption at Kadena. While most companies providing enterprise solutions focus primarily on permissioned systems, Kadena is building both a public network protocol and private blockchain infrastructure. Their Chainweb protocol will soon launch as a public network and smart contract platform. The company claims their novel approach to proof of work offers enormous gains on transaction throughput, even at scale, while benefiting from the same security as bitcoin. Alongside Chainwebs, Kadena is building a permissioned protocol more suited for enterprise applications in insurance and finance.

Topics discussed in this episode:

Monica’s background at the SECThe genesis of Kadena and why the founders left JP MorganKadena’s unique approach to building both public and permissioned protocolsThe Chainweb protocol and it’s approach to proof of workThe incentive mechanisms in ChainwebHow Chainweb protects itself against common attack vectorsThe PACT smart contract languageKadena’s enterprise blockchain offeringThe company’s go-to-market strategy and business model

Links mentioned in this episode:

Sponsors:

: The open, decentralized trading protocol for ERC20 tokens using the Dutch auction mechanism: Deploy enterprise-ready consortium blockchain networks that scale in just a few clicks

Support the show, consider donating:

BTC: 1CD83r9EzFinDNWwmRW4ssgCbhsM5bxXwg ()BCC: 1M4dvWxjL5N9WniNtatKtxW7RcGV73TQTd ()ETH: 0x8cdb49ca5103Ce06717C4daBBFD4857183f50935 ()

This episode is also available on :

Watch or listen, Epicenter is available wherever you get your podcasts.

Epicenter is hosted by Brian Fabian Crain, Sƒbastien Couture, Meher Roy & Sunny Aggarwal.

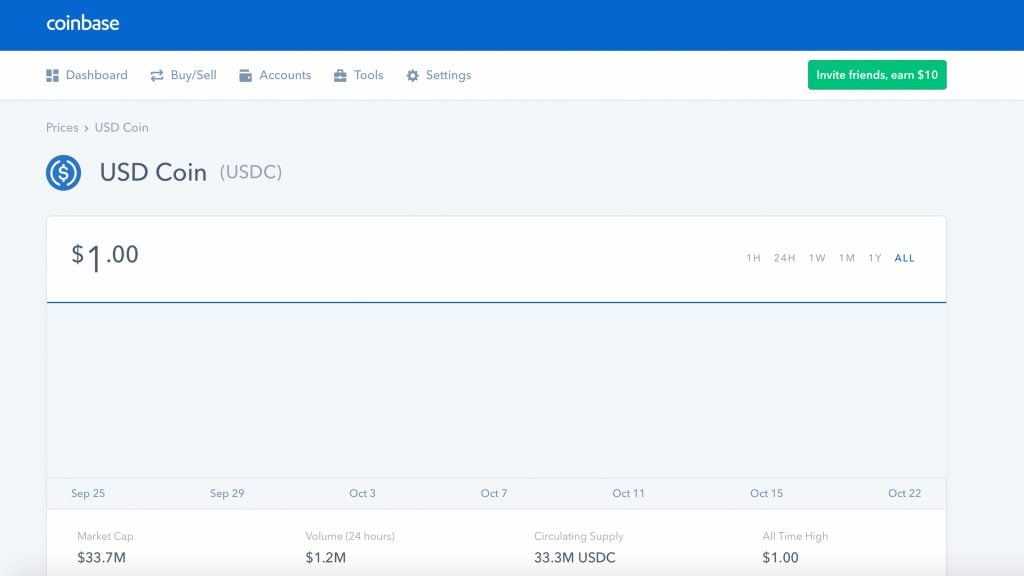

The global cryptocurrency exchange based out of San Francisco, Coinbase, has announced the firm will now support Circle’s USDC stablecoin on its exchange and brokerage service platforms. Coinbase believes that blockchain-based digital dollars like USDC provide many benefits to the cryptocurrency market ecosystem.

Also read:

Coinbase and the USDC Stablecoin

“Each USDC is 100% collateralized by a corresponding USD held in accounts subject to regular public reporting of reserves,” Coinbase explains in its blog post. “The underlying technology behind the USDC was developed collaboratively between Coinbase and Circle, in our capacity as partners and co-founders of the new Centre Consortium.”

Coinbase describes USDC’s benefits throughout the announcement and emphasizes that the blockchain-based digital dollar is far more efficient to send and receive. Additionally, with USDC being an ERC20 standard token, it has the ability to be integrated with applications like Cryptokitties and other Ethereum projects. Lastly, Coinbase considers USDC to be a ‘programmable dollar’ in a sense that makes it easier for developers to add specific functionality.

“For example, given the private keys for USDC, a program can easily send and receive them back and forth using the public Ethereum blockchain,” Coinbase details.

2018 Has Seen a Flurry of Stablecoin Announcements

At the moment, the USDC token is only available on the brokerage side of Coinbase, but the coin will be added to the exchange shortly, the company adds. Coinbase says that the company will be fully compliant alongside Circle Financial by maintaining a “track record of security.” The firm also explains that the two companies’ reputations and compliance-first approach gives them a “unique position” in the growing stablecoin economy.

The Coinbase news follows the Bitpay on Oct. 15, when the payment processor revealed it would support the gemini dollar (GUSD) and the centre coin (USDC) for merchant settlement. Over the last six months, have been added to many exchanges and cryptocurrency infrastructure systems. Most of the recent stablecoin announcements have seen exchanges adding other types of stable tokens besides the popular coin issued by Tether Limited and the Omni Layer.

So far, most of the exchanges and payment processors that boast significant cryptocurrency volume have been adding stablecoins like USDC, GUSD, PAX, and TUSD. Coinbase concluded its announcement by stating that the company has also added USDC to the user-controlled Coinbase ERC20-centric wallet. The addition follows the recent 0x (ZRX) listing Coinbase added to the firm’s lineup of tradable coins.

What do you think about Coinbase adding a stablecoin to the mix? Let us know what you think about this subject in the comments section below.

Images via Shutterstock, Coinbase, Circle Financial, and Pixabay.

At .com all comments containing links are automatically held up for moderation in the Disqus system. That means an editor has to take a look at the comment to approve it. This is due to the many, repetitive, spam and scam links people post under our articles. We do not censor any comment content based on politics or personal opinions. So, please be patient. Your comment will be published.

The post appeared first on .