If you thought that student loans were just for well, student expenses, then think again. A recent survey has found that some college students are using their financial aid to invest in the crypto market.

College is expensive and sometimes, opting for financial aid is the only way to cover fees, rent, textbooks and the list goes on. It also leaves you with a future filled with all of these student bills that have unfortunately graduated with you.

However, according to , some students are doing more with this borrowed money than using it for their college and living expenses.

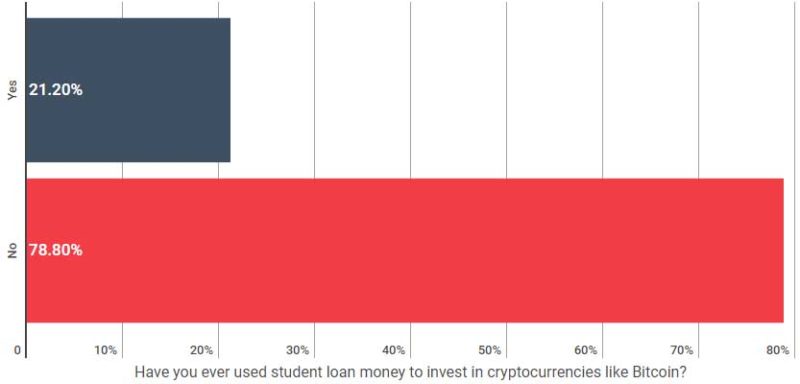

Pollfish, an online polling platform, conducted a survey and according to , 200 out of 1,000 students stated that they have used some of their student loan money to invest in crypto.

A Surprising Result

Founder of The Student Loan Report, Drew Cloud, had this to say:

Younger Americans are certainly the most enthusiastic about cryptocurrency; they are the most active investors and want to get involved in the space in any way possible. However, I truly thought the percentage would be lower. As a college student, your budget is thin and that extra money could be used on rent, groceries, or books.

Possibly Breaking the Rules

While these students might be looking towards a future bright in digital currencies, the legality of using student loan money is uncertain. According to , Elyssa Kirkham, who works for Student Loan Hero, said:

Investing is not an educational expense, so it’s against the rules to use your student loan money to buy cryptocurrencies.

A spokesman for the US Department of Education said:

Federal student aid funds are to be used only to help meet the costs of attending an eligible institution of higher education. Investing is not considered an appropriate use of federal student aid funds.

Adam S. Minsky, a Boston attorney specializing in all things student-loan related, also weighed in:

I would err to the side of it not being a kosher thing to do legally, but regardless of that I don’t think it’s a wise thing to do financially.

Trepidation and Big Numbers

This apprehension most likely stems from the crypto market’s characteristic price volatility. The beginning of saw bitcoin trading at about $1000, while December 2017 saw it reach heights of $20,000.

ICOs were also in the headlines throughout last year with start-ups raising millions of dollars in relatively short amounts of time. In fact, managed to raise $36 million in just one minute.

These price highs and ICO numbers could look quite tasty to students who are living on ramen and toast. However, price unpredictability means that there is no guarantee that these students will see a substantial return on their investment.

Mark Kantrowitz, a student loan expert, explained further:

If you invest the student loans in cryptocurrency and lose money, you will still owe the student loans. And, where will you get the money to pay for college costs?

bitcoin Could Make It Rain for These Students

However, Cloud added that because of this volatility, the pendulum could swing the other way and these students could gain huge returns:

But there is always the chance that there is another period of explosive growth for virtual currency, and these borrowers will be laughing all the way to the bank.

If this is the case, Kirkham believes that the students should be responsible with any profits left over after tax and interest deductions:

If you end up with extra funds, you can return those through your bursar’s office to cancel out some of your debt. That’s the wisest option.

Invest as Much as You Can Afford to Lose

The survey did not specify how much of this borrowed money was being invested but Christian Catalini, an MIT professor who studies cryptocurrency, hopes that it was not a substantial amount:

People should not invest a single dollar in this that they can’t afford to lose immediately. If some of these students have been successful at shortening their loan or something else, I think it’s important to realize that might have been a random, lucky draw.

Even so, the fact that students, and , are even thinking about investing in cryptocurrencies show that the digital age is definitely upon us. Catalini added his thoughts:

There is a new generation of consumers that tend to have no faith in traditional financial institutions, and I think they are approaching this asset with curiosity and excitement.

What do you think about students using their financial aid money to invest in digital currencies? Let us know in the comments below!

Images courtesy of Shutterstock, The Student Loan Report

Published at Fri, 23 Mar 2018 22:00:56 +0000

Altcoins